Feature design • Expedia • 2022

Cancellation For Any Reason

Methods

Workshops

Competitive Analysis

User Research

Stakeholders

Senior Leadership

Developers

Insurance partners

Why?

Covid Chaos Cancelled: Designing Flexible Travel Booking

December 2021 saw travel bookings plummet by 30-50% due to Covid concerns, leaving many frustrated with inflexible policies and lost funds. This case study explores the design of a revolutionary travel booking platform that prioritizes flexibility and affordability. We tackled the challenge of empowering travelers to easily change or cancel trips while ensuring they maximize the value of their travel budget. Discover how we designed a user-centric solution for a post-pandemic world, prioritizing both freedom and financial security.

How?

Introducing CFAR- Cancel For ANY Reason

December 2021 saw travel bookings plummet by 30-50% due to Covid concerns, leaving many frustrated with inflexible policies and lost funds. This case study explores the design of a revolutionary travel booking platform that prioritizes flexibility and affordability. We tackled the challenge of empowering travelers to easily change or cancel trips while ensuring they maximize the value of their travel budget. Discover how we designed a user-centric solution for a post-pandemic world, prioritizing both freedom and financial security.

Primary Research

A Travel Industry Catastrophe

2M

Bookings Cancelled

Reduced claim processing time (From 2 weeks to 3 days)

$500M

Revenue losses

CFAR specific revenue Generated in 2021-2022

103,000

Flights cancelled

Percentage of trips booked with CFAR that were subsequently canceled

77%

Less air travellers

From the pool of people who bought insurance

Secondary Research

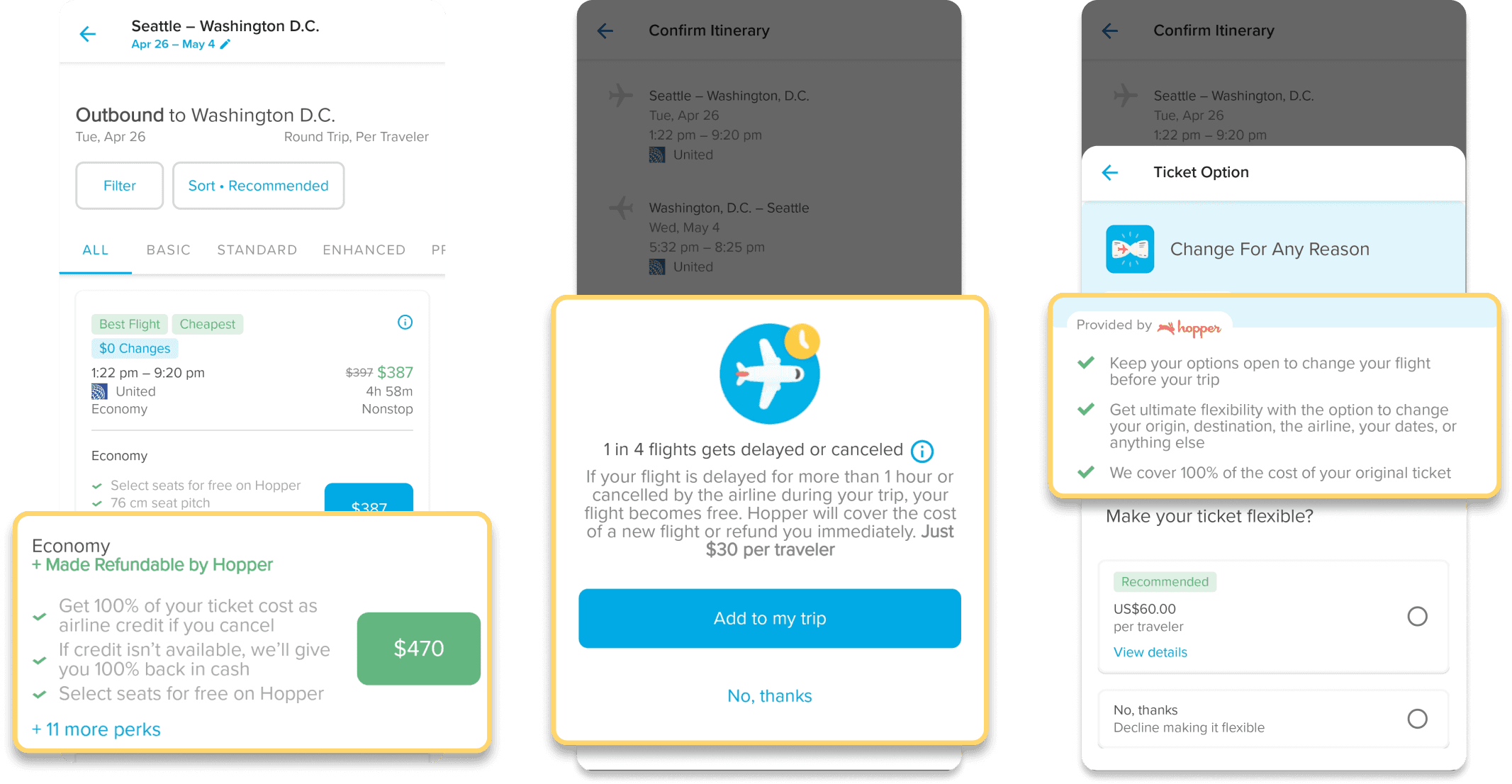

Looking at what everyone’s doing

Top competitor

Hopper

Highlights

100%: Select flights ("Made refundable by Hopper")

Flexible: "Cancel for Any Reason" & "Change for Any Reason" (both ways)

CFAR: 100/80% refund (roundtrip, applies to entire booking)

Refund Method: Airline credit (1 year) or cash

Competitor

Hopper

Kayak

Kiwi

Travelgenio

Gotogate

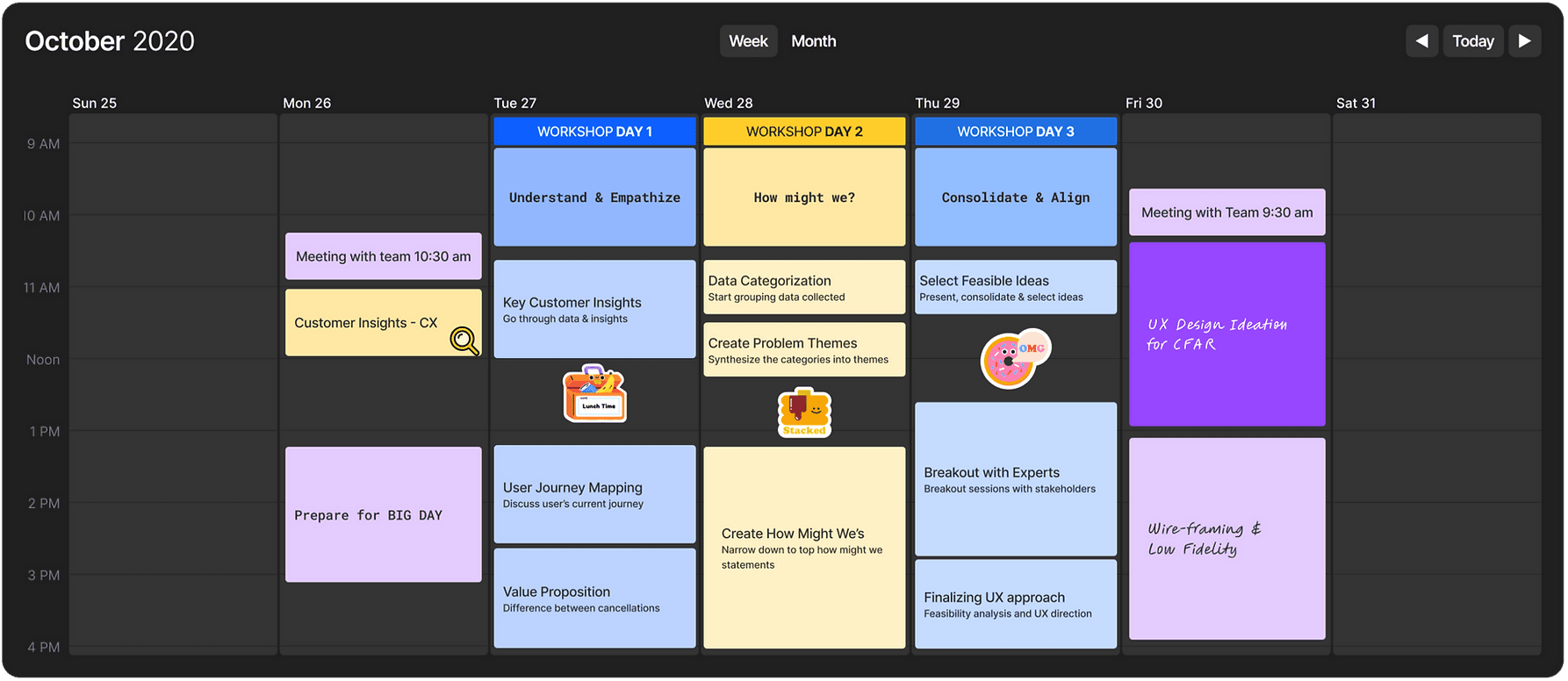

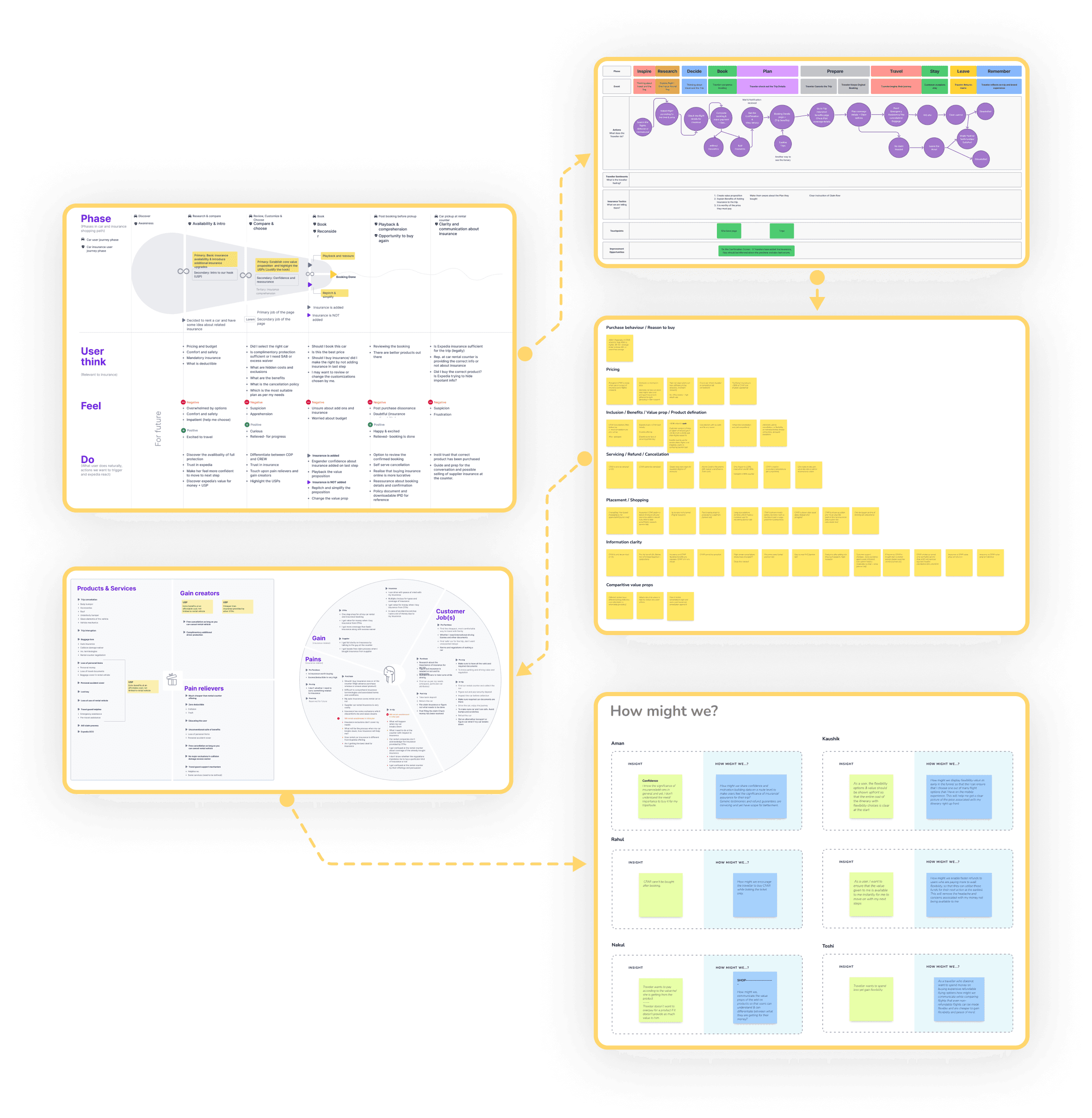

Research Workshop

Unite, Understand, Unfold

We conducted a three-day research workshop for the product stakeholders to come together, understand the user problems, reframe the problem statement into achievable How-Might-We's, and run a robust feasibility analysis with the experts to find the best UX approach.

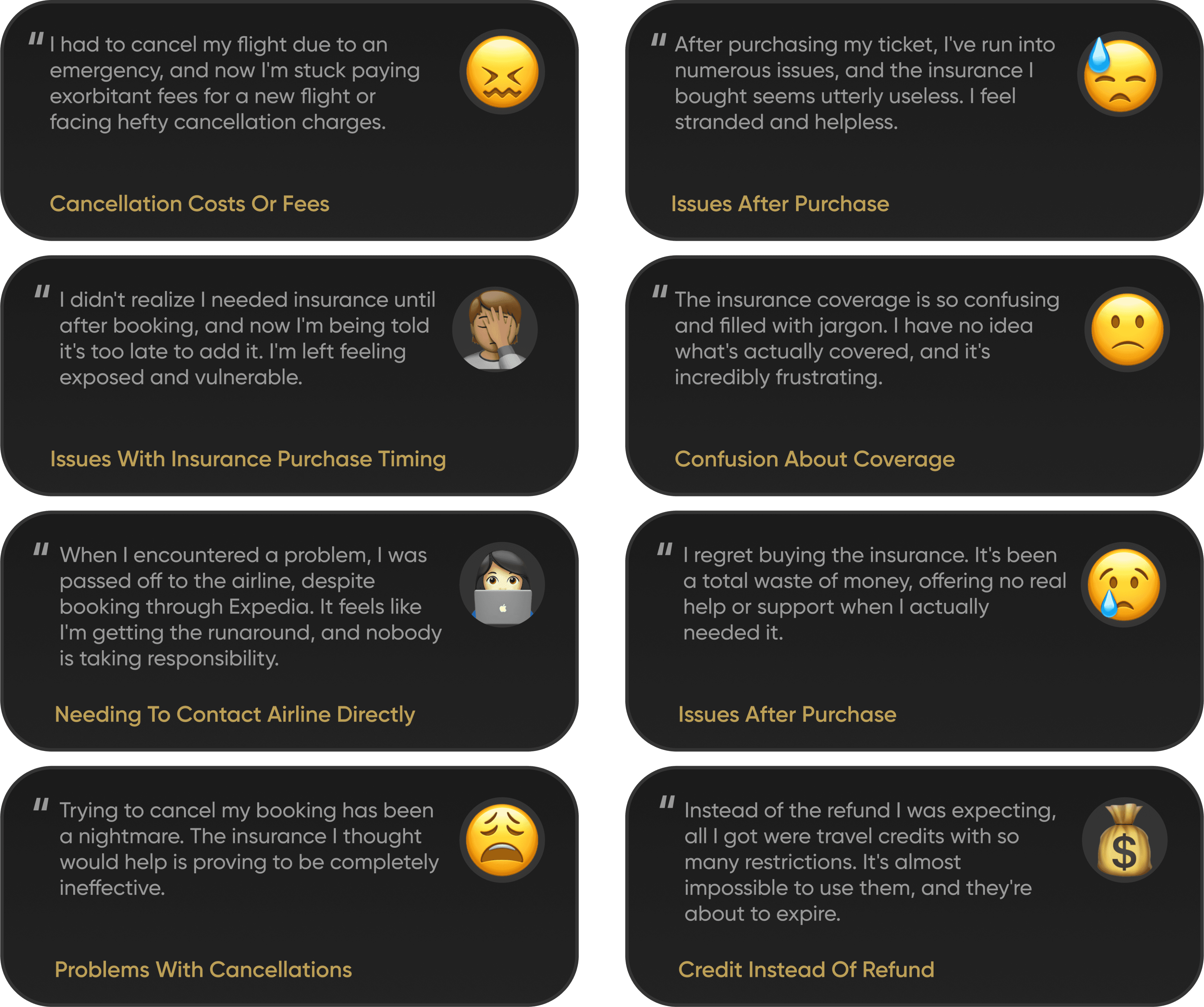

CUSTOMER INSIGHTS

Inflexible Bookings & Frustrated Travelers

Workshop Process

A Collaborative Research Odyssey

The workshop included the following:

Defining User Journeys

Value Proposition Mapping

Grouping Insights

Value Proposition Canvas

How Might We?

Design

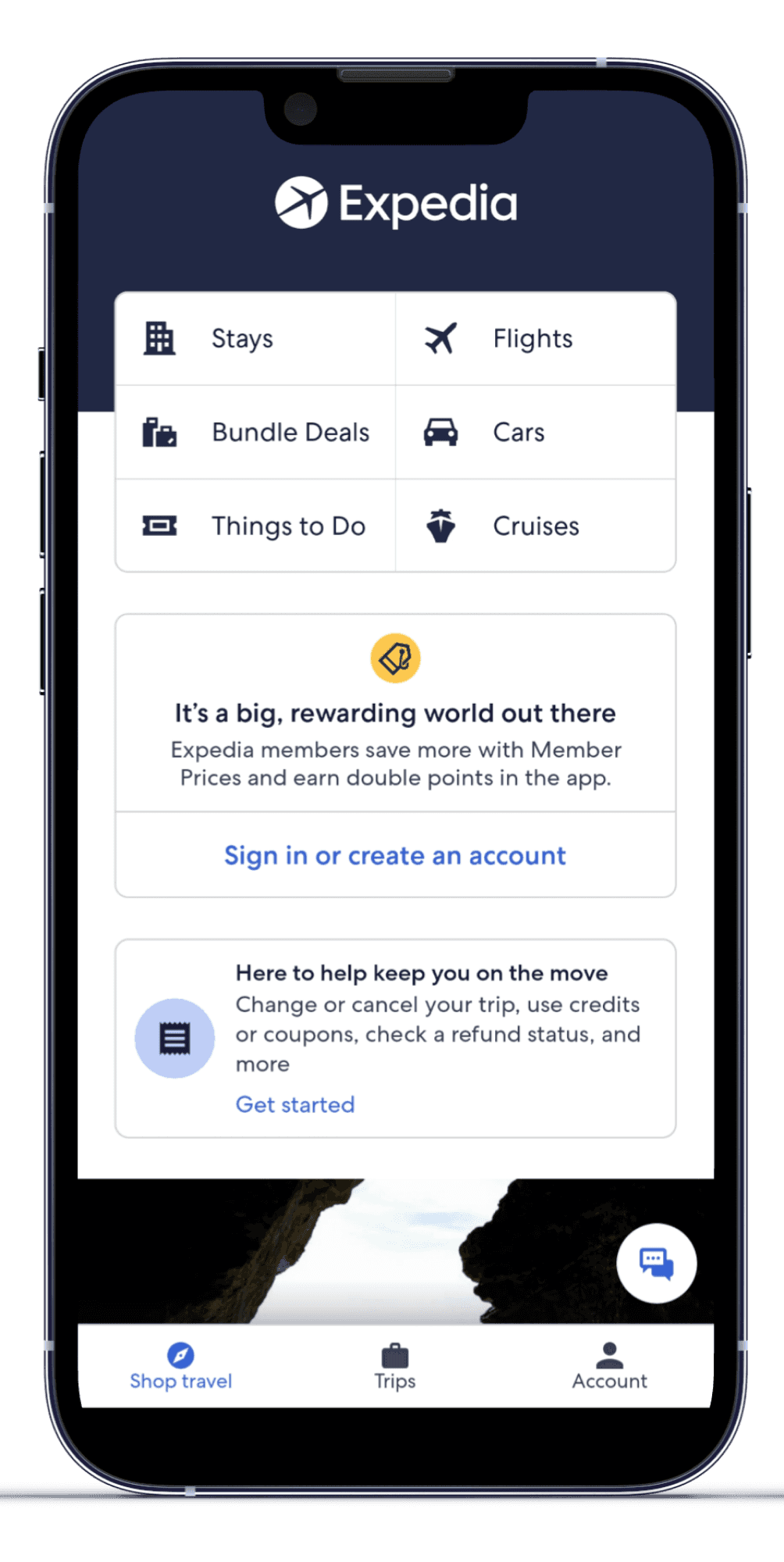

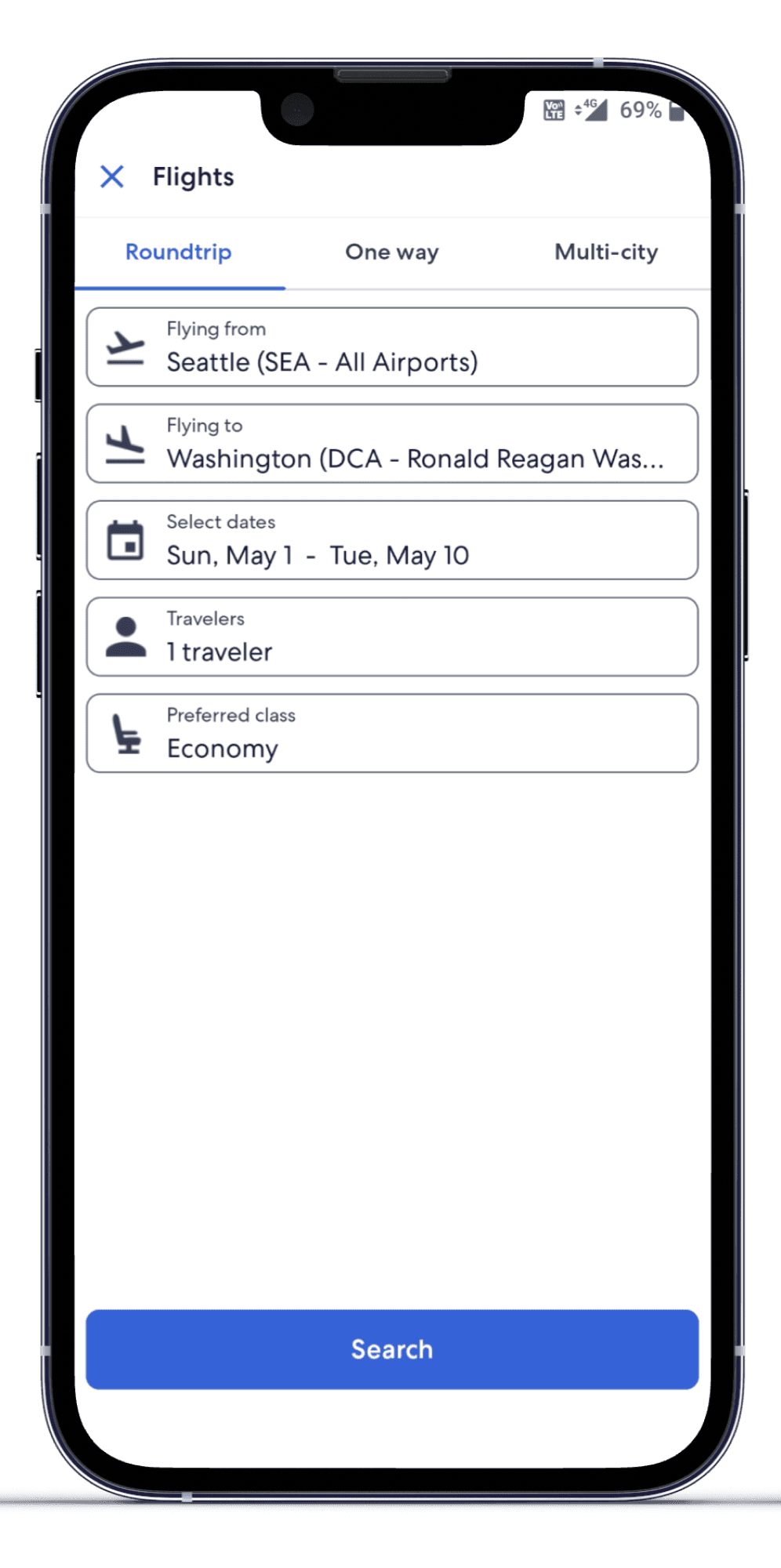

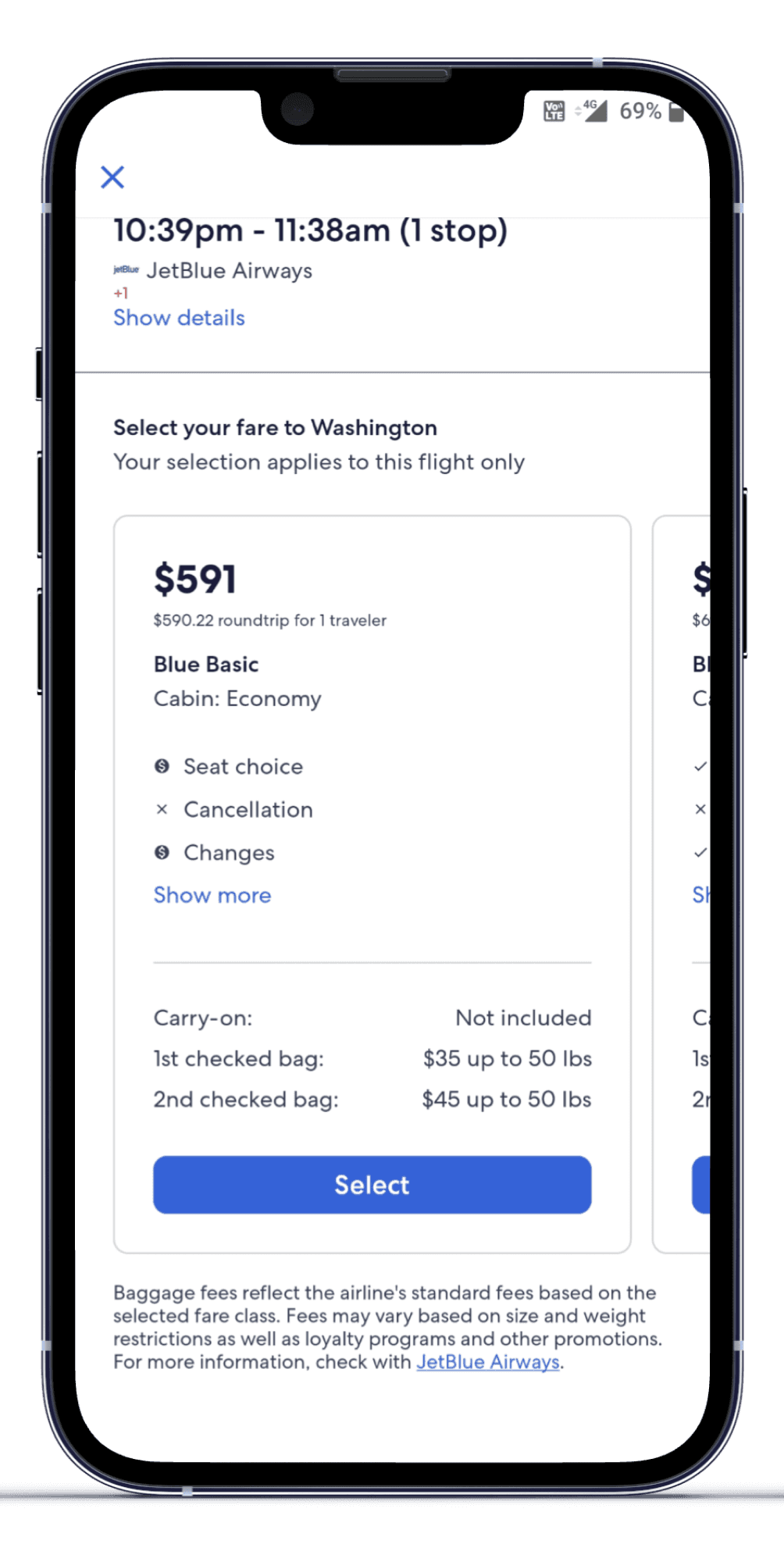

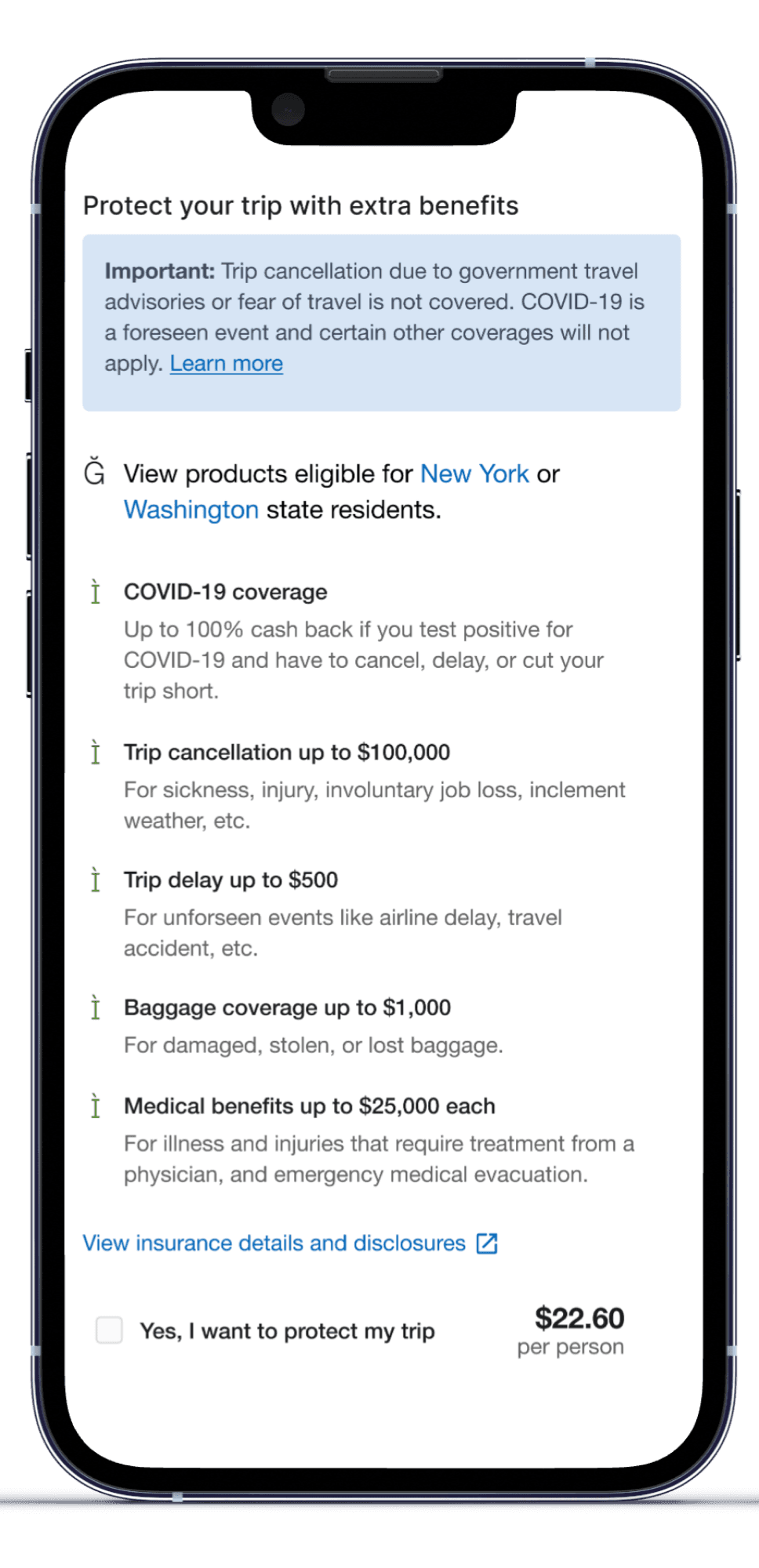

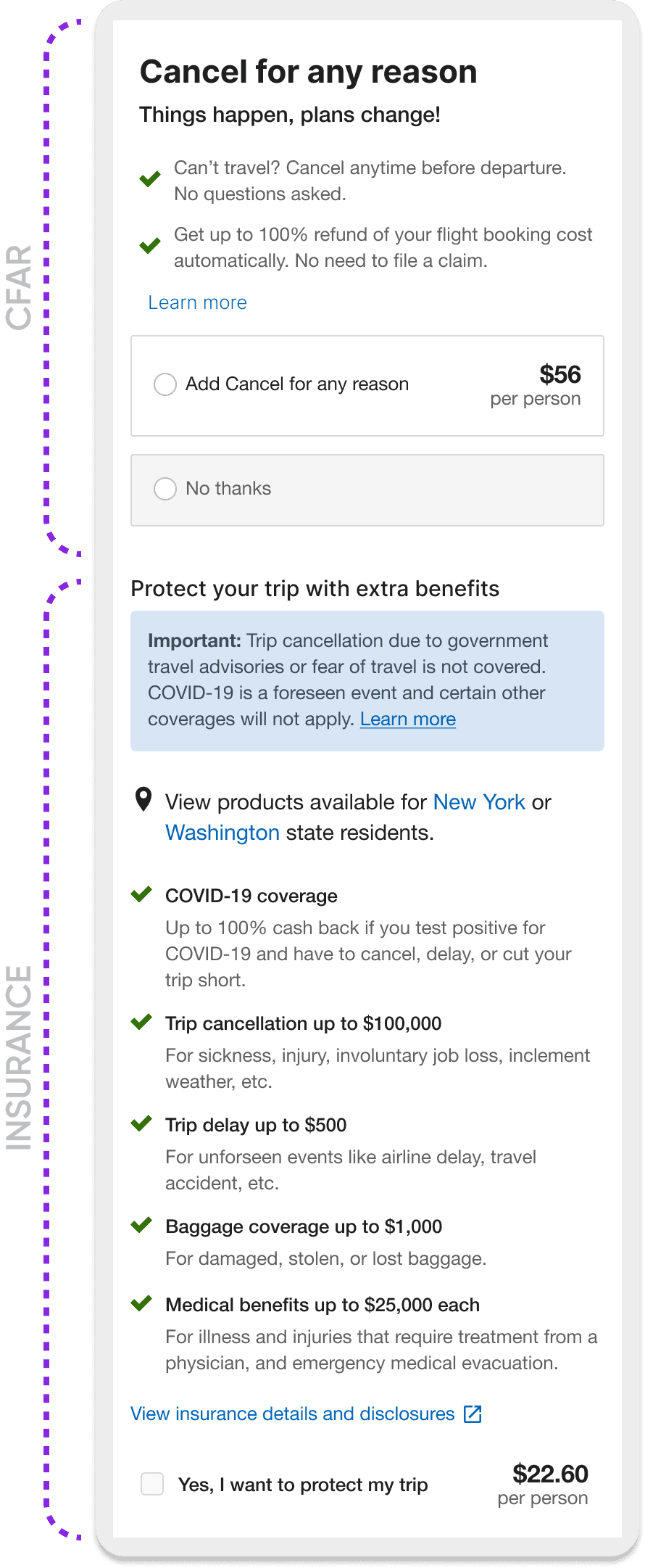

The Journey before CFAR

Below is the flow before the CFAR was implemented.

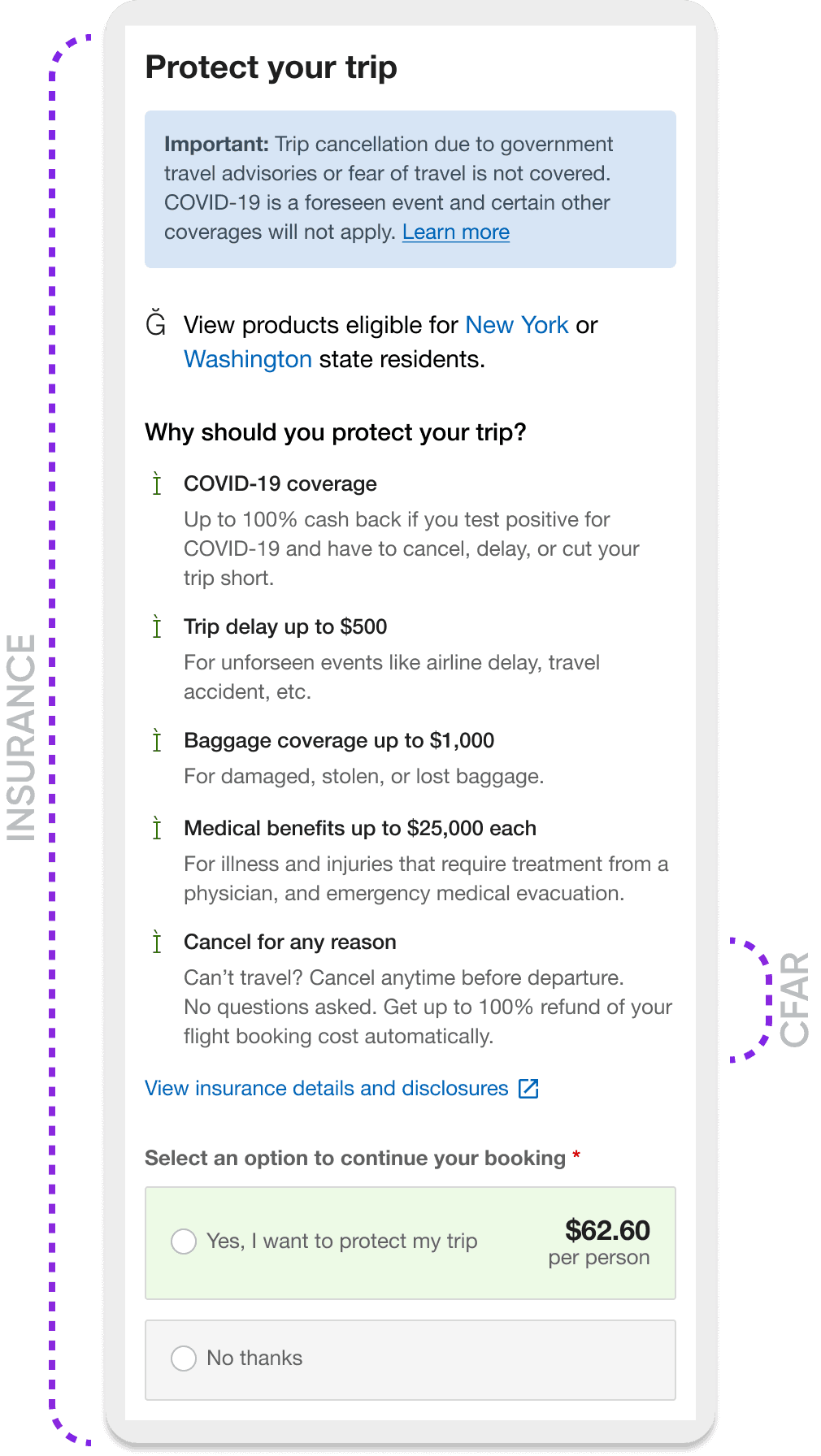

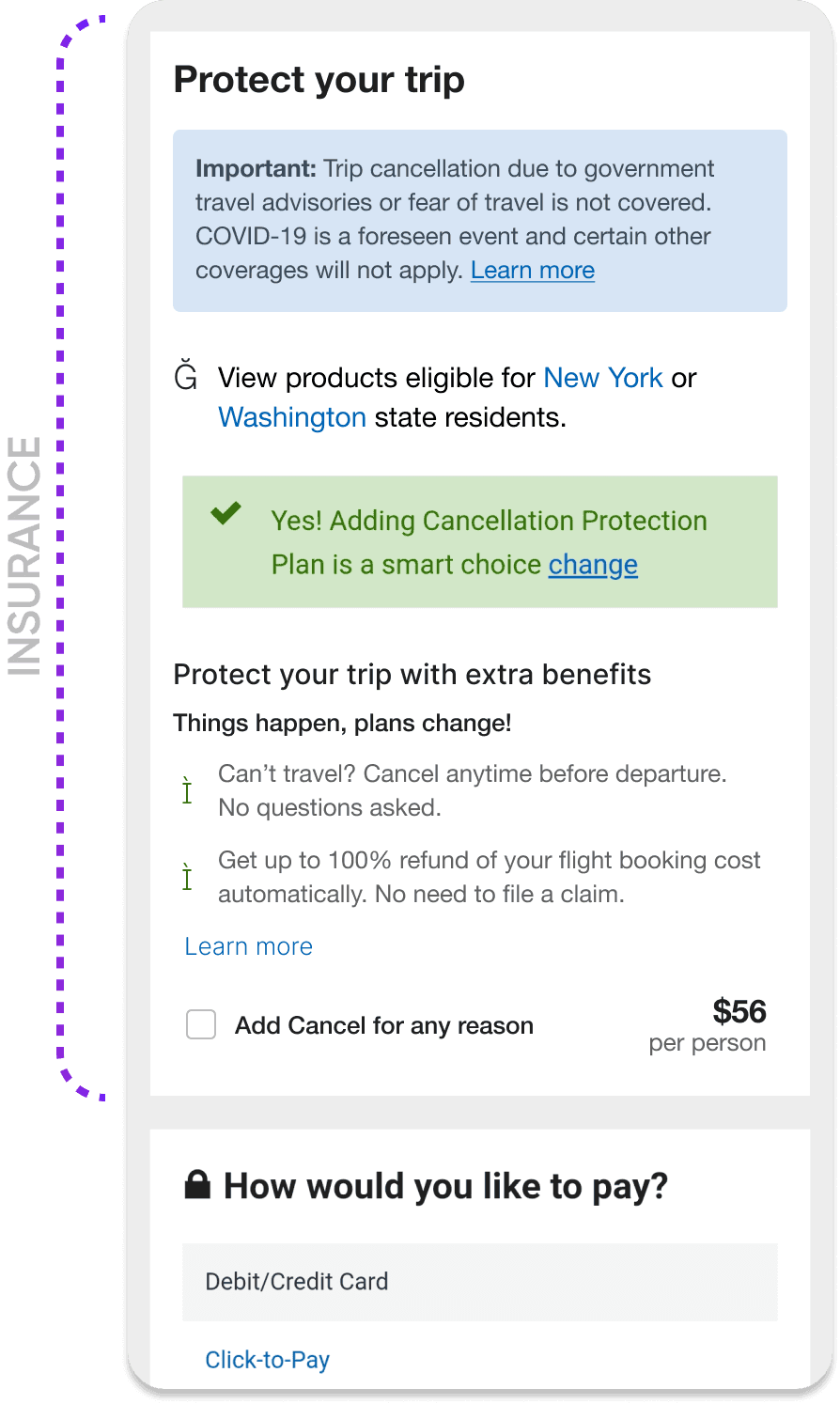

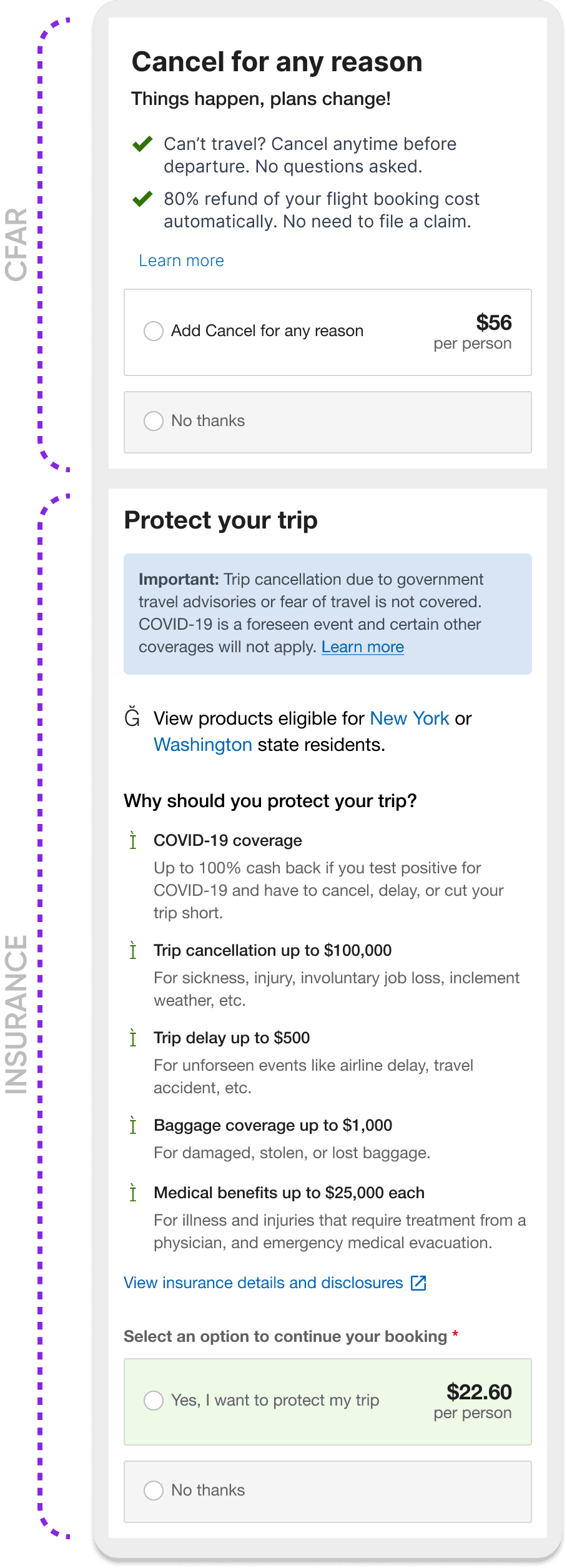

Design

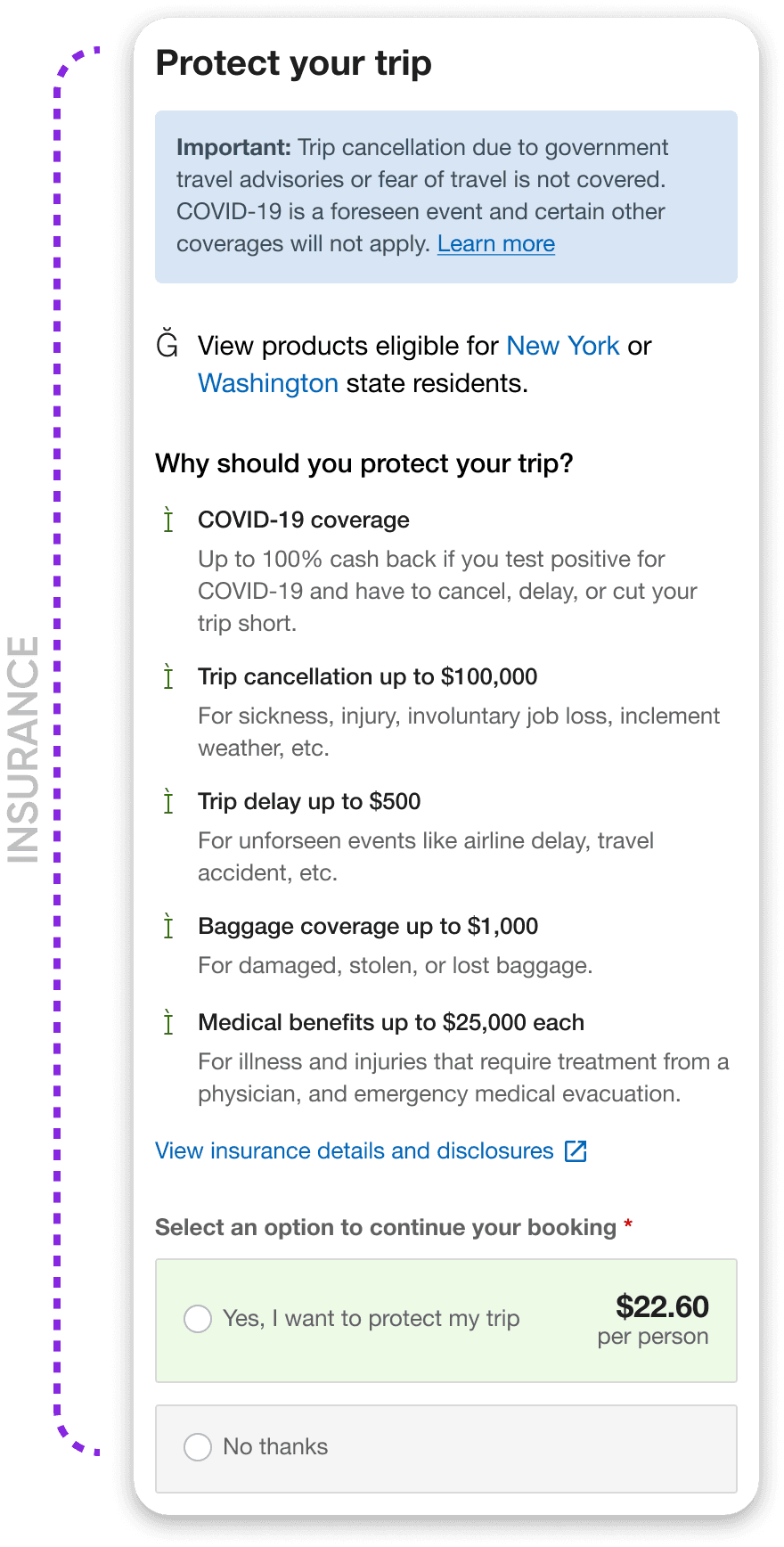

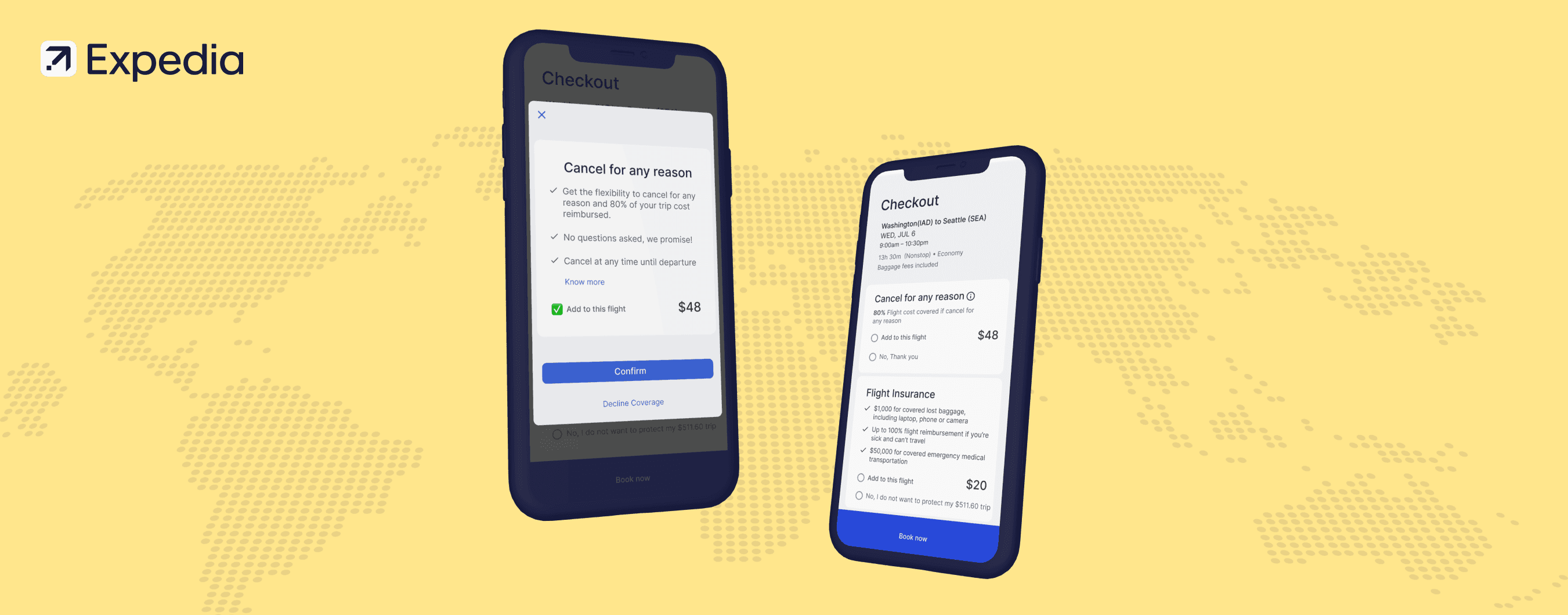

Running T&Ls and A/B tests

We ran multiple P&Cs of the primary variants filtered from a pool of dozens within a controlled target group over a duration of a week. The parameters we judged the variants on are:

Click through rate

Time spent

Clarity in understanding

Task Completion Rate

Time on Task

Click-Through Rate

Impact

Oh, we made some impact!

80%

Reduced claim processing time (From 2 weeks to 3 days)

$15M

CFAR specific revenue Generated in 2021-2022

8%

Percentage of trips booked with CFAR that were subsequently cancelled

15%

From the pool of people who bought insurance

Performance Indicators

Key Learnings

Cashback over Credits

We learnt that even the frequent fliers were deeply interested in cash-back over credits of any kind. they'd rather have their money in their hand, even though the credits could have been more value for money and hassle-free.

Users won’t pay more than 20%

As a matter of fact, we saw that user interest started declining substantially over the 17% premium mark and pretty much disappeared around the 20% premium mark on top of the base ticket price approached.

Future-proofing

COVID was a phase, and once it's gone, it might never return. We learnt that building the product so that it could merge seamlessly with the insurance product in the future without causing substantial user confusion was a great move.

The Future

Questions to answer in future

The CFAR product was later merged into the Expedia Insurance Offering. In case CFAR becomes an independent product sometime in future, the following questions would need to be answered:

Ancillary Coverage

Does the product cover additional charges like paid seats and bags, or just the base fare?

Flight Upgrades

If a user upgrades after booking and then cancels, will the product reimburse the upgrade cost?

Airline Credit vs. Cash Refunds

How does the product handle airlines offering credit instead of cash for cancellations to avoid double compensation?

Travel Season Pricing

Should the product consider peak seasons and holidays when determining pricing?